New Import Taxes for UK to USA Orders – What You Need to Know

If you’re based in the USA and love buying directly from UK makers and sellers, you may have heard that new import tax rules are coming into effect. Don’t worry – ordering from the UK is still quick and easy! Here’s what’s changing and how it works.

What’s New?

From now on, customs duties must be paid before your order leaves the UK. This makes the process much smoother once your package reaches the USA – no unexpected bills or delays at customs.

The duty is 10% of the cost of the item (not including shipping).

For example:

- If your order total is £50, the customs duty will be £5.

- If your order total is £100, the customs duty will be £10.

Who Do You Pay the Duties To?

You have two simple options:

- Pay the seller directly – They’ll collect the duty when you place your order and make sure it’s all taken care of.

- Pay the delivery company – Some couriers allow you to pay them before the parcel leaves the UK.

Either way, as long as the duty is paid before dispatch, your order will arrive in the USA with no extra charges or hassle.

Why This Is Good News

Previously, parcels could sometimes be delayed in customs while buyers were contacted to pay extra charges. Now, everything is settled upfront – meaning faster, smoother delivery to your door.

So, while there’s now a 10% duty to factor in, the process is actually easier for US customers overall.

(Insert your screenshots here to show the official info or checkout examples.)

Summary

- Customs duty = 10% of item cost

- Must be paid before leaving the UK

- Pay either the seller or delivery company

- Orders arrive smoothly in the USA with no surprise fees

That’s it! Simple, clear, and nothing to stop you from continuing to order beautiful, unique items from the UK.

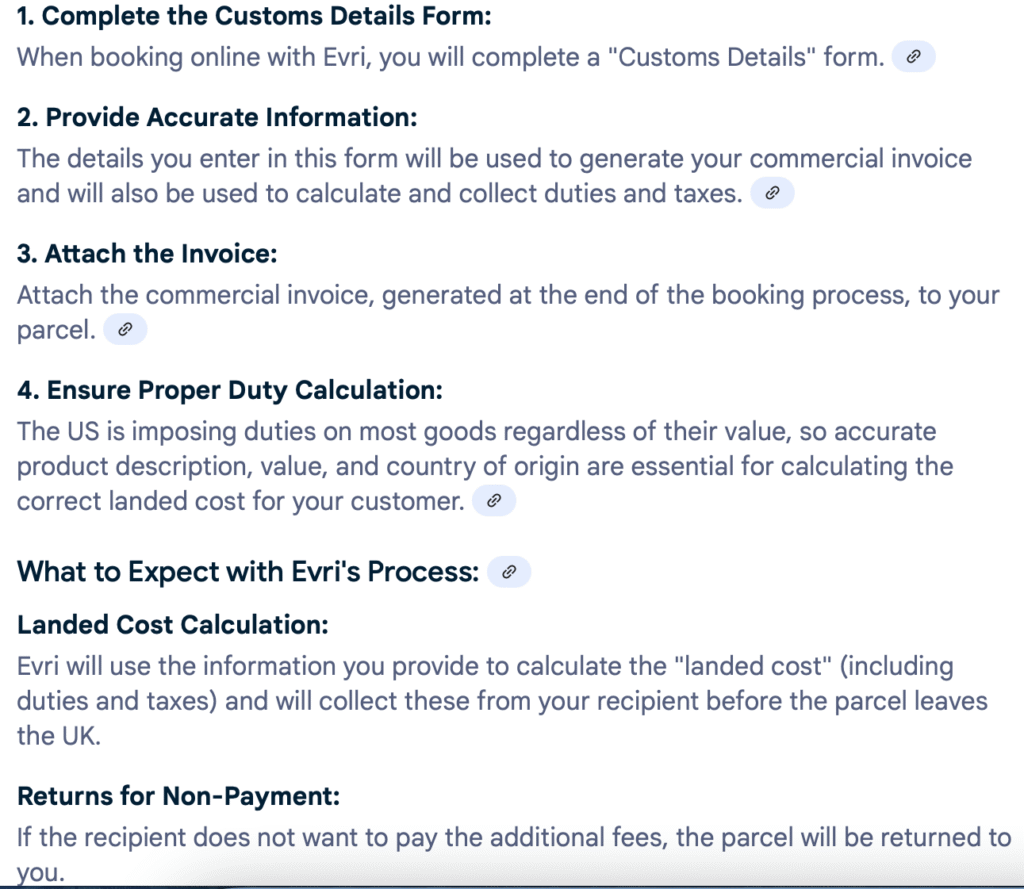

Screen shots just from one UK delivery company to show you they are ready and waiting for your parcels.